The only barrister-backed, strategist-led Self-Administered Family Office in the UK.

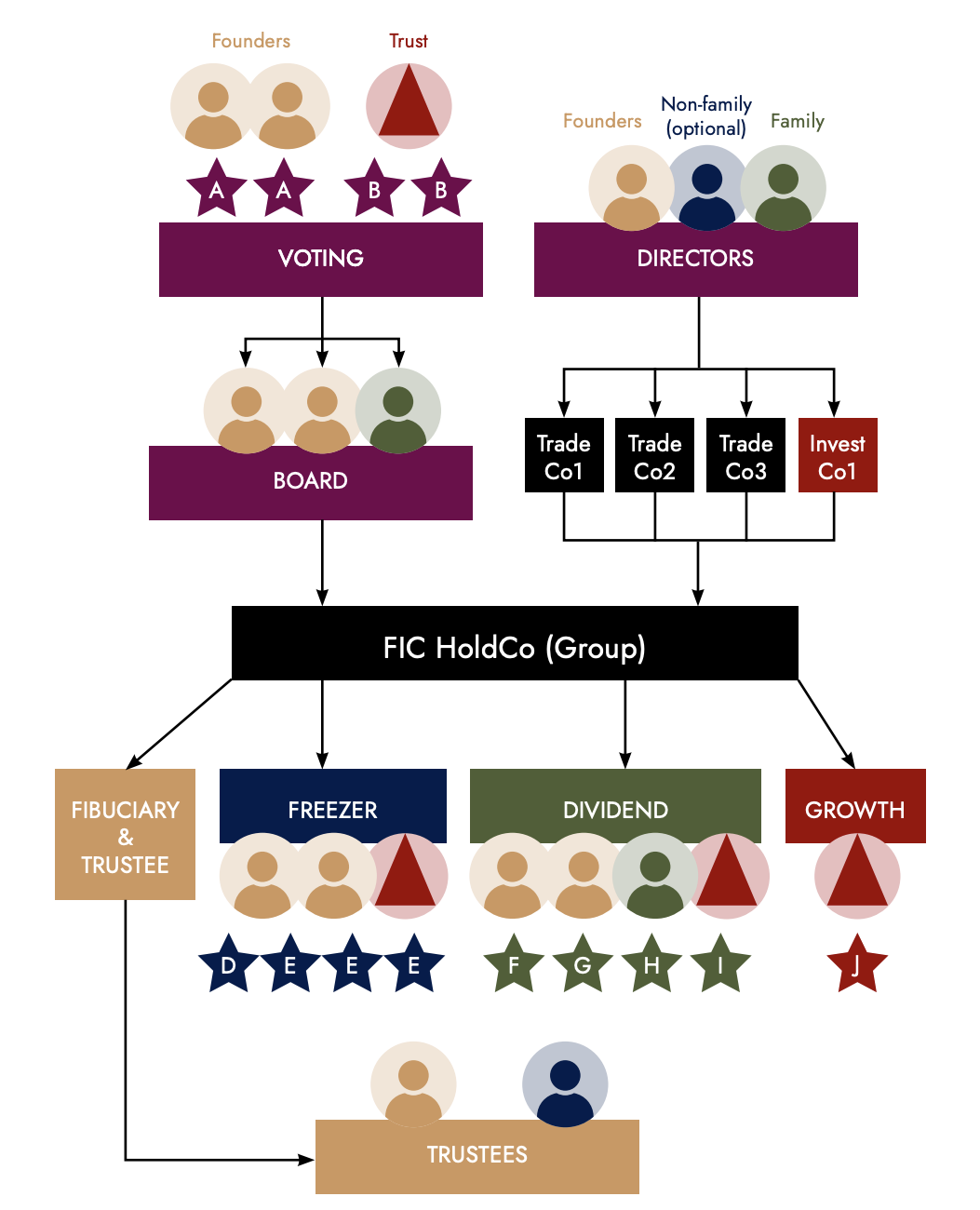

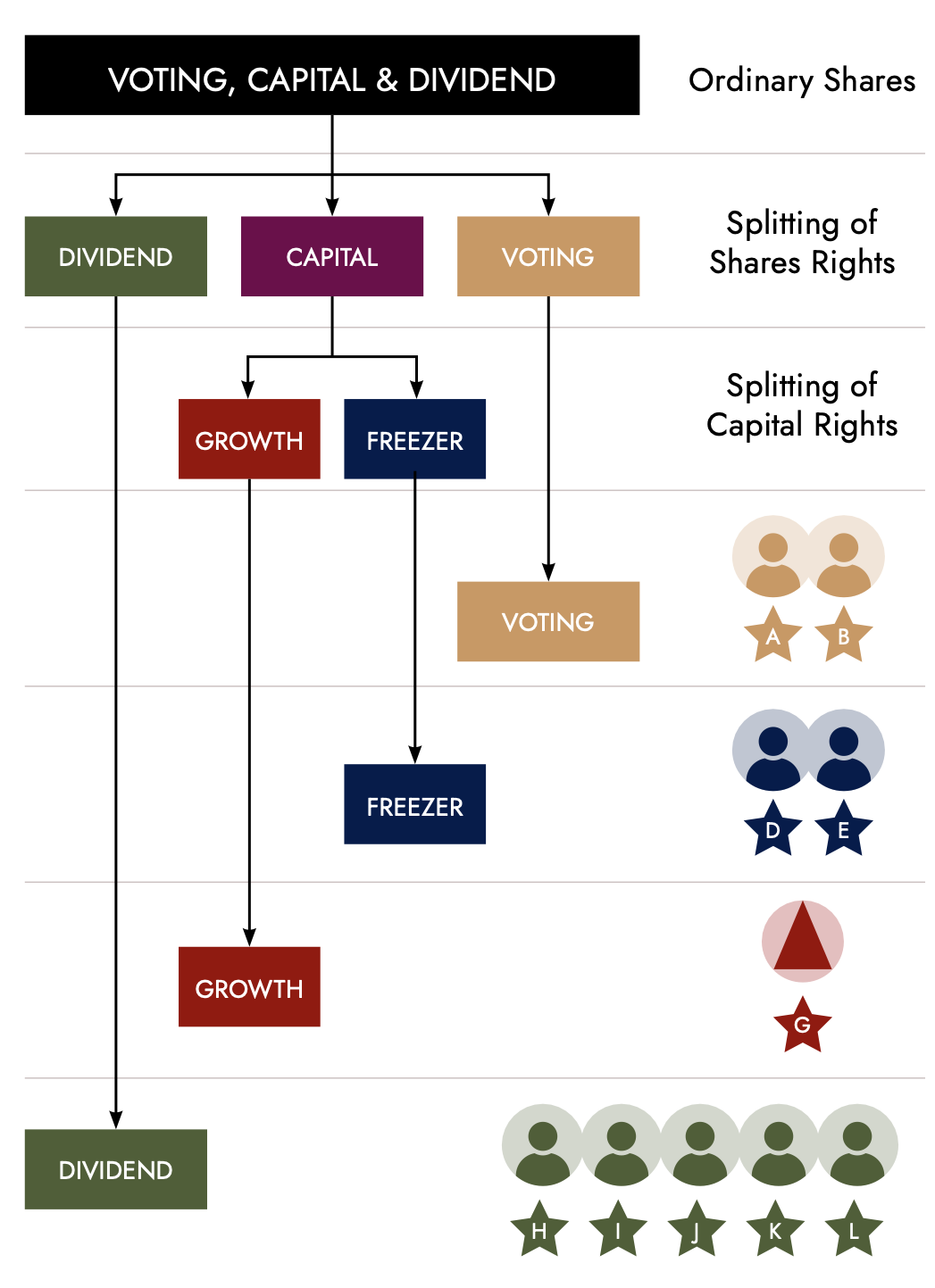

The SAFO is a complete framework (not a product) that enables families with significant wealth to gain the control and flexibility of a family office without the £200k+ annual cost of a fully staffed team. Built on a holding structure with multiple share classes, it separates control, income, capital and growth

Most firms sell Family Investment Companies as investment shells. We integrate trading businesses, succession, and control: because families don’t live in silos.

The Four Share Classes Explained (In Plain English)

Voting Shares:

- Give you decision-making power, but don’t need to carry income.

- Ideal for founders who want to stay firmly in control.

Freezer Shares (Preference Shares)

- Lock your estate at today’s value.

- All future growth is pushed into the next generation or trusts.

- Your wealth stops swelling inside your taxable estate.

Growth Shares:

- Worth nothing today but capture all future upside.

- Perfect for children, grandchildren, or family trusts.

- Keeps compounding wealth away from inheritance tax.

Dividend Shares:

- Carry no control, just income rights.

- Lets you distribute profits tax-efficiently across family members.

- Aligned with each person’s tax band, minimising leakage.

FAQ

Q: “Isn’t this too complicated?”

A: “Not with us as your structural back office. You’ll have the same confidence walking into your accountant’s office as if you had written the strategy yourself.”

Putting It All Together In A SAFO

Imagine the following setup:

Every SAFO is built with barrister oversight and strategic design. The result: a structure that doesn’t just minimise tax: it protects control, preserves family harmony, and empowers you to challenge any adviser with confidence.

Why It Works

Man is sovereign in his own right. We show you how to master the system, not hide from it.